Agricultural Credit Scoring That Actually Works

YieldRank transforms farm data into credit intelligence, enabling lenders to confidently finance Africa's agricultural future with AI-powered risk assessment.

YieldRank transforms farm data into credit intelligence, enabling lenders to confidently finance Africa's agricultural future with AI-powered risk assessment.

Africa’s Agricultural Financing Gap: The Numbers Behind the Challenge

of African smallholder farmers lack access to formal credit

agricultural financing gap across Sub-Saharan Africa

typical loan default rates due to poorly assessed risk

weeks for manual farm assessments at $50-200 per application

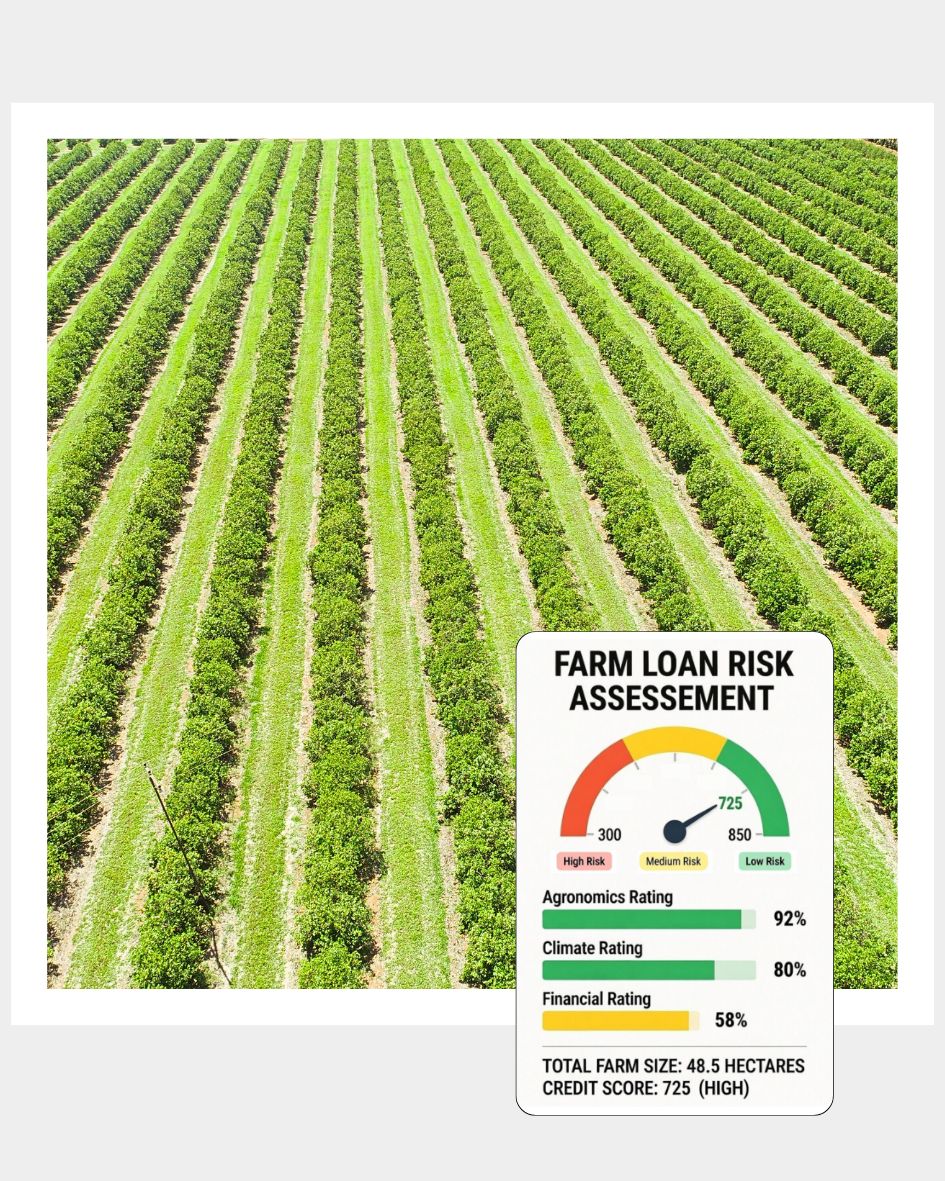

A credit scoring model that prioritizes yield potential, agronomic performance, and on-ground realities over traditional financial history—ensuring productive farms are visible, assessable, and financeable, even without formal records.

YieldRank doesn't ask "Did this borrower repay in the past?" Instead, it asks: "Given this farm's agronomic, climate, and market conditions, how likely is repayment?"

By synthesizing alternative data streams into actionable credit scores, YieldRank makes the financially invisible investable based on productive potential, not paperwork.

Updates monthly throughout the crop cycle, providing a living view of risk aligned with actual farm performance.

Assess productive capacity with crop-soil suitability, historical yield data, and real-time satellite crop health monitoring

YieldRank is designed for institutions financing agriculture at scale, helping them reduce portfolio risk and expand rural credit access.